A Guide to Financial Literacy in Canada (2025)

A rough guide on managing money for Canadians. Learn how to make the most out of your Canadian dollars with this in-depth post.

Updated • read

Table of Contents

I am not a financial advisor! This is my attempt at condensing my financial literacy that I’ve picked up from YouTube and Reddit. I still believe I have written about best practices, and believe this is still helpful.

Finances is a concept that you’re taught in schools on how to manage.

Just kidding. There’s a reason why me, a random trans girl, has written this; no one tells you this stuff. You’re expected to figure it out yourself.

Hopefully this guide serves as a quick path towards gaining financial literacy! Note that this article won’t go much detail into budgeting nor debt management.

What is interest?

Section titled What%20is%20interest%3FLet’s say Alice wants to borrow some money from Bob Financial. If Bob Financial lends money to Alice, Bob Financial may wish to be compensated for that. Along with wanting the original money back, Bob Financial can charge extra money called interest.

Interest is measured in a percentage over time. Many credit cards charge an interest rate of a whopping monthly 20.99%, compounding daily for unpaid borrowed money. If you owed:

- $1,000

- The interest is a monthly 20.99%

- It’s been a month

…you’d owe an extra $232.87. Ouch!

You can calculate this yourself using online tools, such as this Compound Interest Calculator tool.

You also yourself can collect interest yourself, by depositing your money into a financial institution. This is because financial institutions such as banks, credit unions, and fintech companies lend your money. To compensate you, they give you interest.

As of August 2024, the base interest rate in Wealthsimple is a yearly 3.5%, compounding daily. If you do direct deposit $1,000 and waited a year, you’d earn $35.62 of interest.

Compounding interest

Section titled Compounding%20interestCompounding interest is very powerful. If you locked-in your $1,000 in a non-cashable guaranteed income certificate (GIC), that has:

- A 5% yearly interest rate

- Annually compounding interval

- Gets paid out after 5 years

After a year, your GIC is worth $1,050. You earned $50 of interest! However, your principle (the money you put in) increased to that much. Now, the next year, it will be the 5% of $1,050. This means that your interest for the next year will increase! Watch this pattern in this chart:

| Year | Interest | Accrued Interest | Balance |

|---|---|---|---|

| 0 | – | – | $1,000.00 |

| 1 | $50.00 | $50.00 | $1,050.00 |

| 2 | $52.50 | $102.50 | $1,102.50 |

| 3 | $55.12 | $157.62 | $1,157.62 |

| 4 | $57.88 | $215.51 | $1,215.51 |

| 5 | $60.78 | $276.28 | $1,276.28 |

Our original $1,000 has turned into a nice $1,276.28! That’s a lot of money.

Fair warning though, credit card debt compounds also. Watch what happens if we don’t pay off $1,000 of debt, at a 20.99% monthly interest rate, compounding daily;

| Month | Interest | Accrued Interest | Balance |

|---|---|---|---|

| 0 | – | – | $1,000.00 |

| 1 | $209.90 | $209.90 | $1,209.90 |

| 2 | $253.96 | $463.86 | $1,463.86 |

| 3 | $307.26 | $771.12 | $1,771.12 |

We now owe an extra $771.12! Ouch.

Unless you know what you’re doing, generally avoid debt when possible—especially high-interest debt. Credit card debt can potentially drive you into a very bad place, so always pay it off when you can, and treat it like a debit or prepaid card.

Safer ways exist to go into debt when it’s needed, such as lines of credit.

If you have bad spending habits, and are unable to control it, seek a mental health professional! There may be a psychological reason why you overspend. For example, when shopping’s the only time you can be yourself, and you get dopamine, it going to make impulse control significantly harder.

You may also want to check if your provincial government has any resources on debt management. The Manitoba Government has a warning towards individuals seeking a debt-settlement company, where they may try to abuse customers.

If you’re in lots of debt, you may wish to go the path of debt consolidation with a bank or credit union. If you’re in this situation, you may wish to do research on subreddits such as r/PersonalFinanceCanada, as this may affect your credit score.

Reddit links are linked to an alternative front-end called Redlib, through discuss.whatever.social. If for some reason the instance doesn’t work, you can replace the domain with reddit.com instead.

Financial institutions

Section titled Financial%20institutions

Pre-requisites

Section titled Pre-requisitesTo access many of these services, you will need a social insurance number (SIN). If you don’t have one, you can apply for an SIN here!

You’ll also need certain ID. The most common form is a driver’s license. It doesn’t have to be a full one; a trainer’s will do. There’s also provincial ID cards.

Unfortunately, phone numbers are a requirement for signing up to many services. If your phone has an unlocked carrier, you can get a prepaid number online, or at a local convenience store. For best compatibility, avoid Voice over Internet Protocol (VoIP) phone numbers.

If you don’t already have a bank account, you will want one eventually. This helps you get interest on your money, and pay for services.

Recommended financial institutions

Section titled Recommended%20financial%20institutionsHere’s some online financial institutions you could sign up to:

- Wealthsimple: Although not a bank, Wealthsimple is a financial institution that has many functions like one. You may even find that it can replace your current bank, along with being free.

- They also have a free prepaid Mastercard, that gives 1% cashback!

- They’ve recently also introduced free ATM withdrawals, up to $5.

- Wealthsimple is also a major investment platform, where you can buy stocks and ETFs.

- EQ Bank: A banking service promoted on as many services being free. This includes free ATM withdrawals, no non-sufficient funds (NSF) fees, and no money transfer fees (ex. Interac, electronic funds transfers). There’s no fees on mobile cheque deposits, which is a feature Wealthsimple doesn’t have!

- They also have a free prepaid Mastercard, that gives 0.5% cashback.

- EQ Bank also allows you to invest in GICs, although EQ Bank tends to not have the best rates. However, GIC rates change over time, and this may have changed depending on when you read this!

Institutions to avoid

Section titled Institutions%20to%20avoidBranch banks

Section titled Branch%20banksDepending on your needs, you may wish to avoid branch banks. Depending on their plans, you may either:

- Need to pay a monthly fee to bank with them, instead of being free

- You have to keep a minimum deposit, which loses you money due to not being in a high interest savings account, or investments!

You may want a branch if you:

- Want in-person support instead of online or over-the-phone

- Want to exchange cash and have it deposited into your bank account

- Alternately, if you have change, you may wish to simply spend it along with a credit or debit card. If you only have bills, simply ask a person at the cash register to exchange your bills for change. This tip is useful especially for EQ Bank users, with free ATM access to get bills but not coins.

- Don’t want to give an online company your SIN, or deal with as much vigorous Know Your Client (KYC) procedures

If you’re considering a branch, consider a local credit union, as they’re there to serve the community, rather than profit. See The Ultimate Guide To Credit Unions in Canada - Savvy New Canadians for more info!

Online institutions

Section titled Online%20institutionsAccording to many users on r/PersonalFinanceCanada, Neo Financial has a sketchy reputation. Many users report immediate fraudulent charges after one purchase.

KOHO Financial is another one to avoid, as they had numerous issues regarding missing funds and poor customer support.

That said, I’ve heard recommendations of KOHO after these posts were created. For some, KOHO works for them perfectly fine, and is more simpler to use than alternatives like Wealthsimple. Plus, KOHO makes it easy to start credit building, which Wealthsimple doesn’t offer.

Credit cards

Section titled Credit%20cardsUsually, you need either a debit or credit to be able to pay online.

For the best deals, you want a credit card!

Credit cards are a useful financial tool, if used properly. It can help you save money on purchases. They also help you build a credit score, which helps you access services that require a high score.

Things you get with a high credit score includes:

- Access to better credit cards for saving more money

- Being able to rent a living space

- Giving you better rates on mortgages and insurance premiums

- Lower interest rates on loans

Be warned; credit card debt is vicious, as demonstrated in Compounding Interest. Make sure to either pay on time, or set up automatic payments!

Should I use a secured credit card?

Section titled Should%20I%20use%20a%20secured%20credit%20card%3FThese aren’t great deals, they tend to not have good cashback deals. If you need to rebuild your credit score, these may be useful.

If they do claim good deals, make sure they’re not Neo Financial, nor KOHO, due to their reputation. KOHO also charges for the service of credit building—be warned!

Do I need to give my SIN to get a credit card?

Section titled Do%20I%20need%20to%20give%20my%20SIN%20to%20get%20a%20credit%20card%3FNo, you don’t need to give your SIN! See the Key duties of SIN holders - Canada.ca. The Canadian government advocates you do not give your SIN to anyone, unless required by law. This is so that having your identity stolen (ex. for benefits) is less likely. You can’t be denied for a credit card if you don’t give that information.

Good beginner credit cards

Section titled Good%20beginner%20credit%20cardsThis can be a tricky hunt. I recommend you do your own research, especially as this article ages over time. Better credit cards may release, or cards may change their cashback rates or rewards!

I personally lean towards cashback, as it’s simple enough to figure out how much I’m getting back. Calculating your savings is also easier. Unlike reward cards, these can’t vary and change over time without you knowing.

If you do lots of travel, or willing to figure out reward cards, I especially recommend you do your own research! Try searching for “best Canadian credit cards” and see what you find.

Cards to look into:

- CIBC Dividend® Visa* Card for Students

- No annual fee

- No need to prove you’re a student

- 2% on groceries, 1% on gas, transportation, dining, and recurring payments, and 0.5% on everything else

- BMO CashBack® Mastercard®*

- No annual fee

- 3% on groceries, 1% on recurring payments, and 0.5% on everything else

Other great credit cards

Section titled Other%20great%20credit%20cardsOnce you’ve built a credit score, you should look at applying for the following cards:

- SimplyCash® Card from American Express

- No annual fee

- 2% cashback on gas, groceries

- 1.25% on everything else (the highest base rate on a no annual fee credit card!)

- SimplyCash® Preferred Card from American Express

- $9.99 monthly fee, equals to $119.88 per year

- 4% cashback on gas and groceries

- 2% cashback on everything else (the highest base rate on a credit card!)

- American Express Cobalt® Card

- $12.99 monthly fee, equals to $155.88 per year

- 5x points on eats & drinks

- 3x on streaming subscriptions

- 2x on travel & transit

- 1x points on everything else

- 1 point = $0.01, 1,000 points = $10

- Simplii Financial™ Cash Back Visa* Card

- 4% cashback on restaurants, bars, and coffee shops

- 1.5% on gas groceries, drugstore purchases, and pre-authorized payments

- 0.5% on everything else

- Tangerine Money-Back Credit Card

- No annual fee

- 2% cashback on two categories of your choice

- You can choose up to three categories, if you deposit your rewards into a Tangerine Savings Account

- 0.5% on everything else

Alternatively, you can check out the multitudes of websites listing credit cards, especially if you have a mid-to-high income.

- Best Credit Cards in Canada - MoneySense

- Best Credit Cards - creditcardGenius.ca

- Best Credit Cards in Canada - nerdwallet

- Credit Cards - ratehub.ca

What counts as a gas, groceries, etc. on cards?

Section titled What%20counts%20as%20a%20gas%2C%20groceries%2C%20etc.%20on%20cards%3FCredit cards companies categorize merchants with a merchant category code (MCC). Depending on what category code the merchants and the card company agree on (as there’s transaction fees associated depending on the category), the amount of cashback or reward points you get will vary.

Although last edited 2019, you may find the The Ultimate Tangerine MC Category Reference Guide useful.

There are many gotcha’s to what counts! For example, (regular) Walmarts, Costco, and Bulk Barn don’t count as groceries. Walmart Supercentres, however, count as groceries. The only way to make sure what stores have a certain MCC code, is by unfortunately calling the credit card company, and waiting on hold.

If you buy an Amazon (or any other) gift card from a place like Safeway or Sobeys, that counts for the groceries cashback. If you’re already looking to buy from Amazon, this can save you money!

Why still use physical cash?

Section titled Why%20still%20use%20physical%20cash%3FPhysical cash doesn’t cost anything to give, as long as you have the bill or coin on-hand. Credit cards make money by charging merchants transaction fees.

Especially in local markets, depending on the merchant, you can spend less by paying in cash, as this saves the merchant transaction fees.

Physical cash is also more private. Corporations such as Mastercard and Visa sell your transaction data to advertisers, and this helps you avoid that.

Interac e-Transfer is also another way to pay. This isn’t physical cash, but without payment processing fees. These can be through giving the merchant your email, or a card that supports Interac. These will generally be only accepted by local merchants. That also said, merchants may not accept e-Transfer.

Savings

Section titled SavingsYou will want to have liquid savings, in case of emergencies, or a “rainy day”. Unexpected expenses can rear their head, and preparing for it.

With CDIC—a crown corporation that’ll cover your deposits if a member institution fails—you can guarantee you’ll get back your money, usually up to $100,000. A financial institution will advertise CDIC insurance, with this on their promo material and/or webpages.

Some financial institutions may have many institutions under them, such as Oaken Financial and Wealthsimple. Oaken has Home Bank and Home Trust Company, for $200,000 in coverage. Wealthsimple has five unnamed institutions that they won’t disclose due to contractual reasons, for $500,000 in coverage.

EQ Bank has CDIC insurance advertised on their front page.

One of the financial institutions on the higher end of interest rates is Wealthsimple. As of March 17th, 2025, they have a 1.75% compounding yearly interest rate. If you direct deposit your earnings into your account, you can earn a bonus 0.5% more.

EQ Bank as of April 15th, 2025, has a 1.25% base interest rate, with 4.0% if you have a recurring monthly $500 direct-deposited into your account.

If you’re willing to sacrifice CDIC insurance, want a higher interest rate, look into CASH.TO or similar high-interest savings account (HISA) exchange-traded funds (ETFs). You generally want to buy that ETF in your tax-free savings account (TFSA), if you have the contribution room.

Note that certain banks that have investing accounts block HISA ETFs, in order to try and sell you their own significantly-lower rate high interest savings accounts.

Although forgoing CDIC insurance for HISA ETFs is a downside, it is still a fairly low risk to lose your money. Your money is deposited into real cash into National Bank, CIBC, and Scotiabank, and those institutions are regulated to prevent collapse and thus losing your money.

How much savings should I have?

Section titled How%20much%20savings%20should%20I%20have%3FA good rule of thumb is to have three to six months of being able to pay all your expenses, in case you lose your source of income.

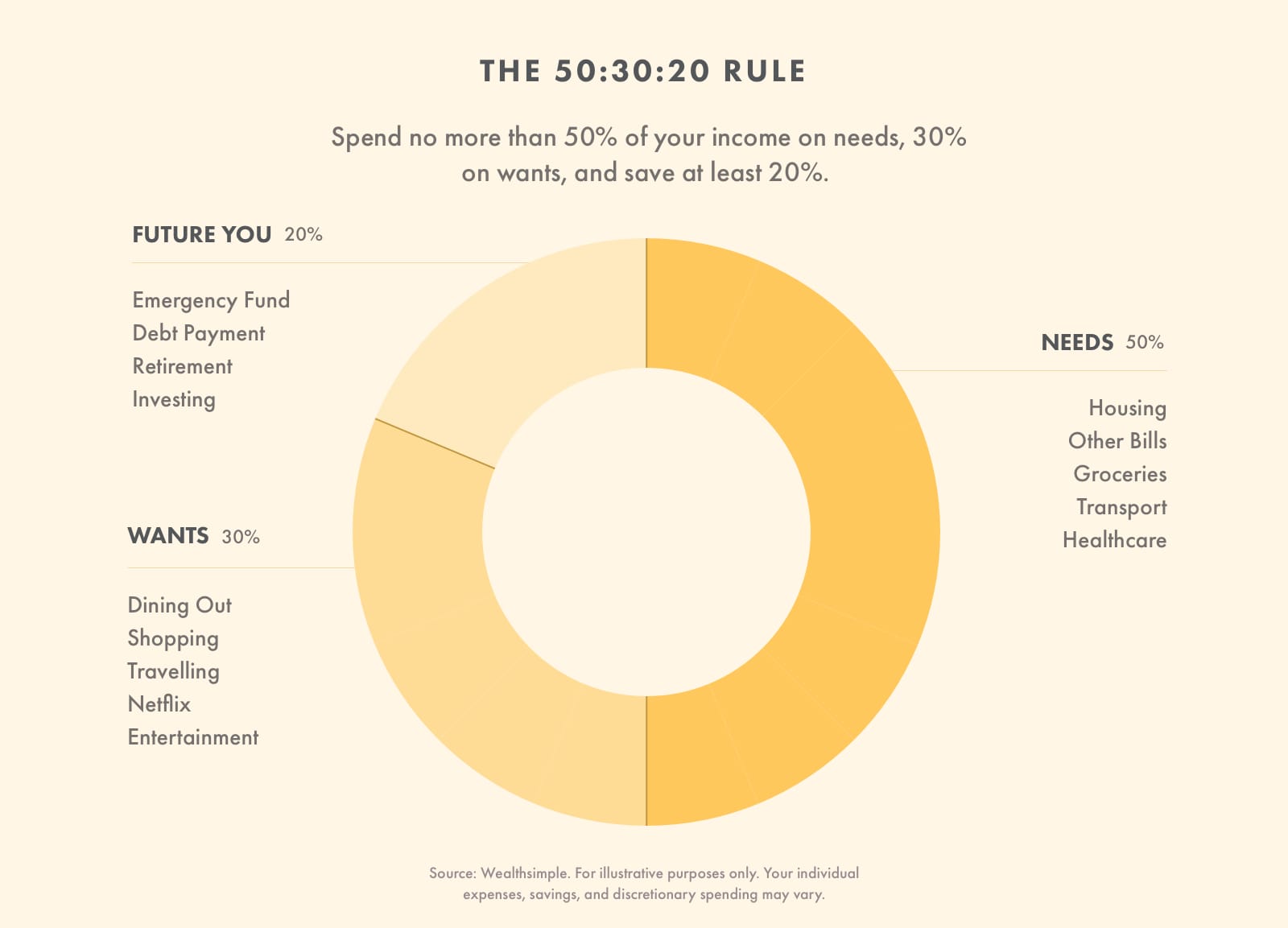

Otherwise, investing is a common way to grow your wealth further. A common guide is the 50:30:20 rule, where you spend 50% on necessities, 30% on things you want, and 20% on investments and debt reduction.

Image taken from Wealthsimple’s 50-30-20 rule article.

Depending on your current existing debt interest rates however, you may wish to pay it off first before saving or investing.

If you’re on this site, you’re likely a lower-incomer earner. You may have heard of the 30% rule for expenses. If you’re in this income bracket and privately renting, you almost definitely will be expending greater than 30% of your income.

If the video The Origins of the 30% Rule and Why We Should Ditch It - Radical Planning’s comments section is any indicator, you may be exceeding the 50% on just housing costs.

Investing

Section titled InvestingEventually, when you have a substantial amount of money that you don’t plan to spend (ex. $1,000), you definitely want to consider investing.

Investing is usually a risk of gaining or losing money. You can control how much risk you take, depending on your investments. Individual stocks are risky, and exchange-traded funds (ETFs) generally lean towards less risk. Securities that have high speculation are considered the most risky (ex. cryptocurrencies).

Risk Management

Section titled Risk%20ManagementOne way of limiting risk is with diversification. Instead of picking individual stocks, one could buy into a ETF that invests in hundreds or thousands of stocks. You can spread your risk across a whole market, verses betting on a handful of companies doing well.

XEQT is an example of a medium risk ETF. XEQT is made out of other ETFs, designed to make up a diverse portfolio that covers the global stock market. If you’re looking to not take your money out, and to invest for the long term (10+ years), XEQT is a great ETF.

If you’re looking for less risk, you may want fixed-income investments. This includes bonds and GICs. Certain ETFs such as XGRO may incorporate fixed-income into their ETF portfolio. XGRO has a 70/30 split on equities (stocks) and fixed-income. XBAL has a 50/50 split on equities and fixed-income.

Should I use Managed Investing?

Section titled Should%20I%20use%20Managed%20Investing%3FManaged Investing has significantly better rates than trust funds, which take 1.00-2.00% of your earnings, verses 0.25-0.50%. But, you will likely get a slightly better deal investing in ETFs on your own. They take a 0.20% Management Expense Ratio/MER.

The benefits of managed investing is that they’ll help you assess and re-assess what your risk tolerance is, and balance your portfolio accordingly.

The most well-known platforms for managed investing is Wealthsimple with a 0.50% fee, and Questrade with a 0.25% fee on your earnings.

If you don’t want to deal with picking out an ETF, this may be your best choice.

Registered accounts

Section titled Registered%20accountsThese are some of the registered accounts you can have in Canada, as long as you have a valid SIN.

These accounts have lots of caveats to look out for! If misused, you can lose a lot of money and permanently lose contribution room. I highly recommend reading the article linked (or doing your own research!).

These registered accounts are misleadingly labeled savings account. Think of it as investment accounts, where you invest in safe ETFs that will grow over the long term. By just putting cash in, you lose the opportunity to invest, and therefore gain more money over time!

All registered accounts have a limit towards how much money you can contribute! There’s also a limit towards how much you can pull out any given year, or may have permanent changes if you pull out.

- Tax-free savings account (TFSA): Any gains you’ll make are (generally) tax-free, even when you withdraw money. Once you turn 18—or depending on what year you became a resident in Canada—you gain contribution room. Use a TFSA calculator to figure out your contribution limit.

- Registered retired savings account (RRSP): Income put in your RRSP is tax-deferred. If you put money in, you won’t be taxed on it, until you take money out. This is useful for when you retire, and earn less income. That way, you pay less in taxes. Contribution room is calculated based on your reported income. Withdrawing permanently removes contribution room, so withdraw only when you must!

- First Home Savings Account (FHSA): Look into if you’re looking to buy your first home within the next 15 years. If you go over the 15 year limit, you can have that money carried to your RRSP.

- Registered education savings plan (RESP): Look into this if you with to enroll in post-secondary education, or you wish to plan to save for your child to go into post-secondary for more info.

You can find a full list, along with important info on accounts, on Savings and pension plans - Canada.ca.

Tax-Free Savings Account (TFSA)

Section titled Tax-Free%20Savings%20Account%20(TFSA)A TFSA makes the most sense to start when investing. You can withdraw your money either in the short or long term, with the added benefit of gains being tax free!

If you completely fill up your TFSA contribution room though, then it is worth investing into other types of registered accounts.

The only penalty for withdrawing from a TFSA is losing contribution room. You lose the amount of contribution room you pull out, until next year rolls over. When next year hits, you get that room back, and can add that same amount of money back in.

This is unlike other registered accounts, which have more limitations on withdrawing.

It is possible to “gain” contribution room, by making investments that grow over time. Any gains that you make in your TFSA can be taken out, and after the year rollover, you can put your gains back without going over your contribution limit.

For example, your investment of $100 turns into $105. You can take out $5, and after the year rollover, you can add $5 back in, plus your new contribution room for that year.

However, it is possible to “permanently lose” contribution room.

For example, your investment of $100 turns into $95. If you take out that $95 left, you lose $5 of contribution, even after the year rollover.

This is meant to encourage safer, longer-term investments.

Conclusion

Section titled ConclusionWow, you read the whole entire thing! I admire your focus, and I appreciate you taking the time to read it.

If you have ADHD, and/or just decided to scroll to the bottom, you might find learning about finances easier through YouTube, and searching in my favorite search engine specific queries, such as site:reddit.com How Does CASH.TO Work. It worked for me!

I hope you found this guide helpful!